How It Works

As in any marketplace, sellers register on one side and buyers on the other. In this case, the sellers are the Loan Originators, who offer a part of their claims on loans they have already issued. And the buyers are the investors who want to buy these claims. In both cases, for regulatory compliance and money laundering prevention reasons, both parties must first undergo a KYC process. In addition, originators must pass a strict due diligence process.

- Loan Originators: once registered, they can upload their already issued loans to our platform and offer for sale in the marketplace a part of the interest to be collected. This process is done through a partial interest assignment. The Loan originator keeps a percentage of the interest receivable, as the risk and responsibility for recovery from the borrower remains exclusively his own; and the investor will receive a part of the interest offered by the Originator.

- Investors: once registered, they will be able to invest in those Loan Assignments that are of interest to them and will receive payments in the wallet which is held in a segregated account.

About Claim Assignment

The assignment of a claim is a procedure whereby the holder of a claim (assignor) transfers to a third party (assignee) the right to collect an existing debt. This assignment can be total or partial.

In this marketplace, all credit assignments offered are always made partially, which means that the Loan Originator assigns only a part of the interest receivable generated by the loan and keeps for himself a part of the interest, as well as the responsibility for the collection.

The loan is not purchased, only the right to collect part of the interest is acquired from the Loan Originator. Therefore the investor does not acquire any rights over the borrower, nor can the investor claim any payment from the borrower. And it is exclusively the Loan Originator who is obliged to pay the agreed interest to the investor.

In the event of default, the investor may claim exclusively from the Loan Originator, who must pay the investor the allocated interest in addition to the principal, regardless of whether the borrower has paid or not.

Flow of Funds

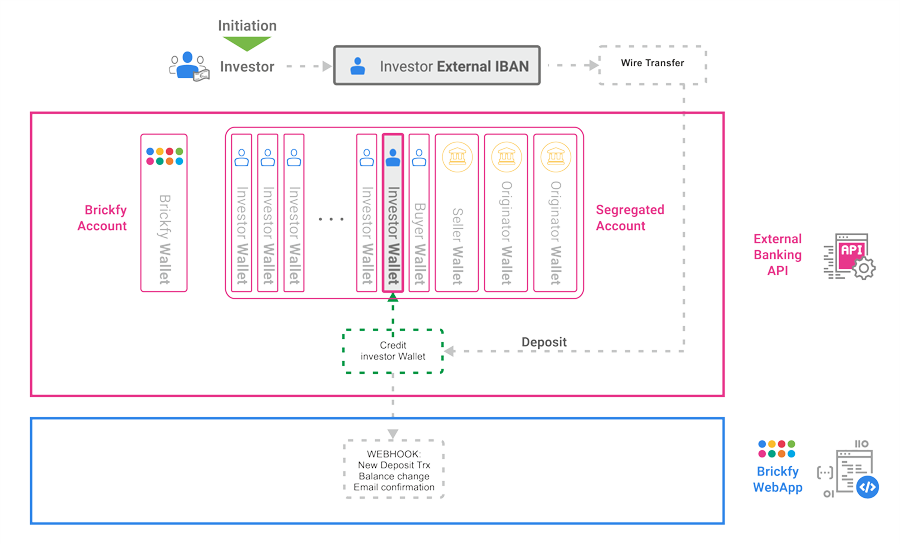

Deposit:

Before investors can invest they must make a transfer from an external account to top up their wallet.

Originators also deposit funds into their wallet when they need to have a balance to pay returns on Claims sold.

Deposits are commission free except in the case of SWIFT transfers where the depositor would be charged a fee.

Deposits from accounts not held by the user are not accepted.

The funds are held in a segregated account with a regulated financial institution, thus ensuring compliance with financial regulations.

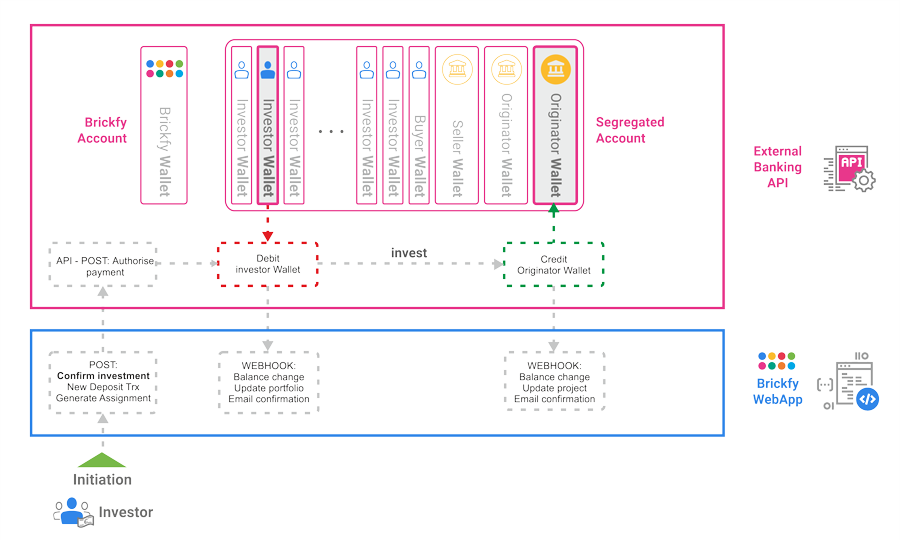

Invest:

Investment transactions are initiated by the investor.

To do this they must have a balance in their wallet or make a deposit in order to have enough funds.

Once the investment order is confirmed, the transaction is generated and funds are transferred directly from the investor's wallet to the Originator's wallet.

The amount invested is deducted from the investor's balance and is available in the Originator's wallet, which can then be used to initiate instalment payments or for withdrawal of funds to an external account held by the Originator.

There is no investment fee for investors.

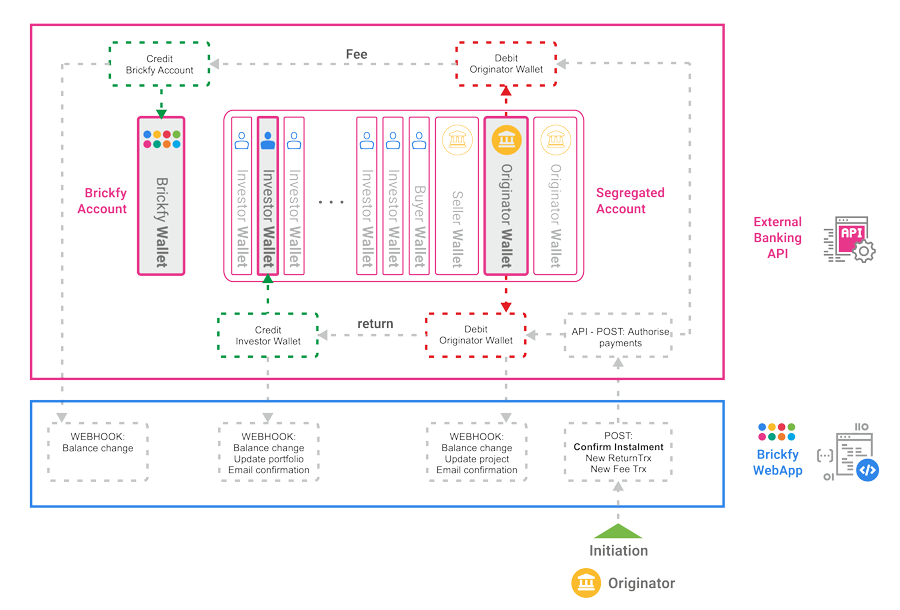

Return:

Returns are initiated by the Originator.

Once they collects the corresponding installment of the loan from which they has sold a Claim (or the buyback guarantee comes into effect), they must pay the buyers.

To do this they must have a balance in their wallet or make a deposit in order to have enough funds.

Upon confirmation of the instalment, a bunch of simultaneous transfers are made to the wallet of each investor.

And one additional transfer to Brickfy is made by the Loan Originator as a fee for the use of our marketplace.